Mobilising and Making Sense of Adaptation Finance and Pro-Poor Climate Risk Finance

Climate adaptation finance is a dynamic and multi-layered field that encompasses public budgets, international climate funds, blended finance instruments, private investment, and enabling policy environments. Yet, despite growing recognition of the urgency of adaptation, global financial flows remain far below what is required to reduce climate risks and build resilience at scale (UNEP 2025, ODI 2023, CPI Adaptation Finance, Climate Adaptation Finance Index, Mitchell 2025).

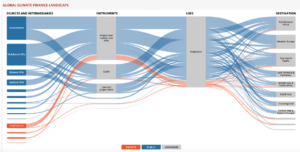

At PlanAdapt, we provide tailored knowledge support and advisory services designed to help governments, private sector actors, multilateral and bilateral partners, and civil society navigate the complex and rapidly evolving landscape of climate adaptation finance (CPI Global Landscape of Climate Finance Data Dashboard). Our work focuses on strengthening the integration of adaptation considerations into financing strategies, public and fiscal policies, investment decisions, and broader funding mechanisms — all with the aim of translating financial flows into resilient development outcomes.

There are plans and ambitions, even though currently behind expectations (see adaptation aspects under the New Qualified Finance Goal, NCQG), to scale and innovate in the area of adaptation finance (OECD 2023, WRI 2025). This will also depend on innovative financial Instruments for climate adaptation (CPI 2024, IISD 2023, GCF 2021) and new ways of channelling funding to the most vulnerable (LIFE-AR, UNCDF LoCAL), while there is an imminent risk of divestment in highly exposed and climate-vulnerable geographies, leaving behind the ones that are least responsible for the climate crisis.

Bridging Finance and Policy for Adaptation Impact

PlanAdapt helps actors understand not only how much finance is flowing but also how finance can be shaped, targeted, tracked, and governed so that it delivers measurable adaptation outcomes. We customise our advisory support to match the priorities and decision contexts of different stakeholders:

For national governments and public agencies, we support the design and implementation of fiscal and budgeting policies that integrate adaptation priorities into medium-term expenditure frameworks, climate budget tagging, public investment planning, and national climate finance strategies. This includes advising on how to align national adaptation planning processes with funding strategies and public-financial management systems, and how to attract international climate funds and concessional support into domestic policy cycles.

For multilateral and bilateral partners, we provide analytical frameworks and evidence syntheses that map the adaptation finance landscape — including public, private, and blended finance contributions — and offer actionable insights for strategic decision-making, programme design, and evaluation of climate adaptation portfolios.

For private sector investors and financial institutions, we help interpret and contextualise adaptation finance data, identify investment opportunities that strengthen resilience and reduce risk exposure, and advise on how to integrate adaptation considerations into corporate strategy, risk assessments, and environmental, social, and governance (ESG) frameworks.

Across sectors, we support work that translates complex finance data into operational insights — clarifying flows by source, instrument type, recipient, sector, and outcome; identifying barriers to investment; and mapping opportunities to leverage finance for systemic adaptation outcomes.

Analysing and Mapping the Adaptation Finance Landscape

Making sense of adaptation finance requires rigorous analysis of global and regional data, trends, and emerging instruments. PlanAdapt has developed expertise in synthesising and interpreting finance data from multiple sources, allowing our partners to better understand:

- the size, direction, and composition of climate adaptation finance flows;

- the types of instruments (grants, concessional loans, blended finance, private equity) driving resilience investments;

- the political, institutional, and regulatory factors that enable or constrain adaptation finance mobilisation; and

-

the alignment between national adaptation priorities and actual investment flows.

Strategic Advisory for Resilient Investments

In collaboration with partners, we support the design of funding strategies and advisory products that (a) strengthen national and sub-national adaptation investment plans; (b) align public financial management with adaptation outcomes through climate budget tagging and green public investment criteria; (c) inform policy reform to unlock private investment, including risk-sharing mechanisms, guarantees, and blended finance solutions and (d) support evaluation and tracking systems that measure finance flows against adaptation outcomes.

Our approach emphasises contextualisation — recognising that adaptation finance is not one-size-fits-all, but must respond to country priorities, institutional capacities, and sectoral needs.

Capacity Strengthening and Institutional Integration

To ensure that insights translate into practice, we work with partners to strengthen capacity for adaptation finance, including training for public officials on climate finance tools, enhancing private sector understanding of adaptation investment risks and returns, and supporting multi-stakeholder dialogues on finance strategies. We embed capacity strengthening in advisory engagements so that organisations can not only access finance but effectively plan, manage, and account for climate adaptation investments over the long term.

Read more about previous PlanAdapt initiatives and projects in this area of work:

- Financing Locally Led Adaptation Action Through International Climate Finance – Putting the Right Mechanisms In Place

- Scaling Impact: Evaluation Scalability in the Adaptation Fund's Portfolio

- The Role of Private Finance and Investment in the Promotion of Climate-Smart Technologies in Agriculture

- How to Finance Climate Change Action in a Country That is on the Doorstep of the European Union

- Innovative Financing For Ecosystem Management in Africa

- Would the Next Major Crisis Hold Also ‘Opportunities’ for Transformational Change in Europe’s Economy? And What Role Do Climate Impacts Play in This?

- Making Sense of the Vast Global Landscape of Climate Finance